Personal Data: The Emergence of a New Asset Class

I discovered an interesting white paper this morning, entitled, “Personal Data: The Emergence of a New Asset Class,” published by the World Economic Forum. The introductory page describes the issue:

I discovered an interesting white paper this morning, entitled, “Personal Data: The Emergence of a New Asset Class,” published by the World Economic Forum. The introductory page describes the issue:

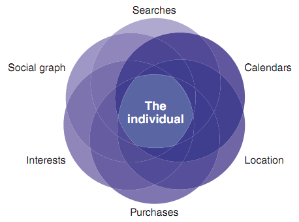

This personal data – digital data created by and about people – is generating a new wave of opportunity for economic and societal value creation. The types, quantity and value of personal data being collected are vast: our profiles and demographic data from bank accounts to medical records to employment data. Our Web searches and sites visited, including our likes and dislikes and purchase histories. Our tweets, texts, emails, phone calls, photos and videos as well as the coordinates of our real-world locations. The list continues to grow. Firms collect and use this data to support individualised service-delivery business models that can be monetised. Governments employ personal data to provide critical public services more efficiently and effectively. Researchers accelerate the development of new drugs and treatment protocols. End users benefit from free, personalised consumer experiences such as Internet search, social networking or buying recommendations.

And that is just the beginning. Increasing the control that individuals have over the manner in which their personal data is collected, managed and shared will spur a host of new services and applications. As some put it, personal data will be the new “oil†– a valuable resource of the 21st century. It will emerge as a new asset class touching all aspects of society.

The report uses a definition of personal data provided by the World Economic Forum in June 2010:

Personal data is defined as data (and metadata) created by and about people, encompassing:

- Volunteered data – created and explicitly shared by individuals, e.g., social network profiles.

- Observed data – captured by recording the actions of individuals, e.g., location data when using cell phones.

- Inferred data – data about individuals based on analysis of volunteered or observed information, e.g., credit scores.

The report concludes:

Personal data will continue to increase dramatically in both quantity and diversity, and has the potential to unlock significant economic and societal value for end users, private firms and public organisations alike.

The business, technology and policy trends shaping the nascent personal ecosystem are complex, interrelated and constantly changing. Yet a future ecosystem that both maximises economic and societal value – and spreads its wealth across all stakeholders – is not only desirable but distinctly possible. To achieve that promise, industries and public bodies must take coordinated actions today.

Five major recommendations are explored in depth:

- Innovate around user-centricity and trust

- Define global principles for using and sharing personal data

- Strengthen the dialog between regulators and the private sector

- Focus on interoperability and open standard

- Continually share knowledge

As both an owner of personal data and as an Identity and Access Management practitioner, I find this subject compelling and timely. Â The white paper is certainly worth the read.